Agility and Hyper-Relevance: The Sales Challenges for 2023

Selling into a Difficult Economy

The challenges of the past three years – virtual selling, supply disruption, and inflation – required skills that were new to many salespeople. In contrast, selling into a difficult economy requires the same core skills that underpin success at any time.

Lead generation needs to be energetic and hyper-relevant. Latent needs need to be made explicit through insightful questioning. Momentum needs to be built using psychology and strategy. Pitching needs to reflect changing decision criteria. New risks need to be identified and alleviated. Margin needs to be defended against Procurement. Existing accounts need to be mapped and routes to growth identified. And renewals must be tackled well before they come due.

There are differences when selling into a recession, but they are largely differences in mindset, scale, and pace. Salespeople need to take responsibility for what they can control. To be resilient – avoiding getting into the “panic spiral” that can set in when results are disappointing. And to be even more rigorous in the way they execute their core skills.

The Need for Agile Skill Development

While the skills needed in 2023 are familiar, your priorities will keep shifting. One month, the imperative might be rebuilding your pipeline, but the next might be negotiating with Procurement, reducing churn, or even optimizing cashflow.

Sales leaders and managers need to be agile. They need to identify and respond to priority skill gaps quickly and effectively; it’s too slow and expensive to procure, configure, and embed new skill development each time.

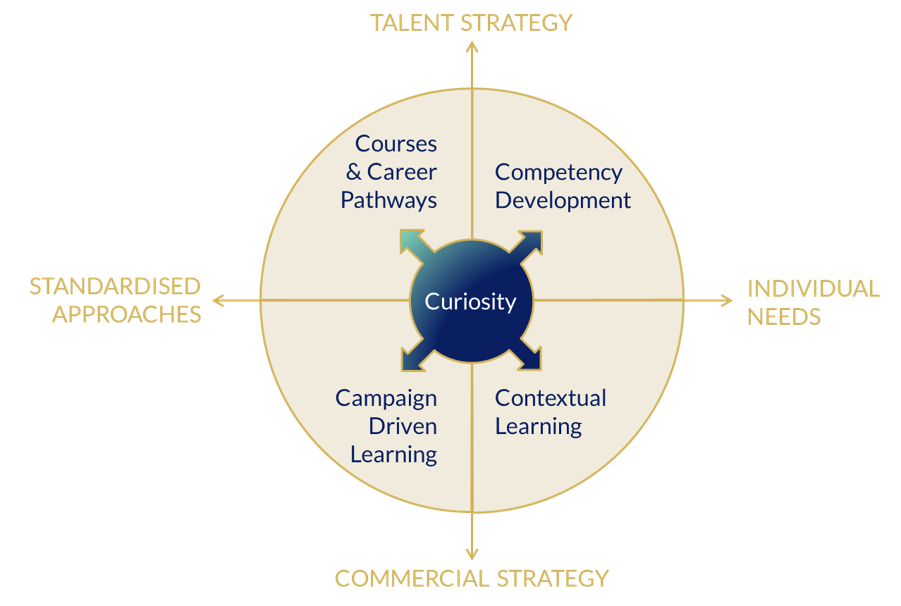

That’s why, at Imparta, nearly 80% of our clients now work with us through what we call Training as a Service (TaaS). Our complete, modular curriculum allows organizations to address changing priorities in an agile way. Supported by technology, it helps companies balance their talent and commercial strategies, and to achieve standardized approaches while responding to individual needs. There are five main use cases, as shown below.

The five Cs are:

- Courses and career pathways. Complete courses and a robust change process to build core skills where they are lacking.

- Campaign-driven learning. Leveraging modular and topical content to respond rapidly to emerging strategic priorities, e.g., win rate, pipeline, or new product launches.

- Contextual learning. Using application tools, micro-learning assets, peer support, and curated “playlists” to support specific commercial tasks.

- Competency development. Using coaching or assessments to identify specific knowledge and skill gaps, then closing them with courses, modules, or micro-learning.

- Curiosity. Leveraging a salesperson’s engagement in one topic to encourage them to explore others.

Likely Sales Challenges for 2023

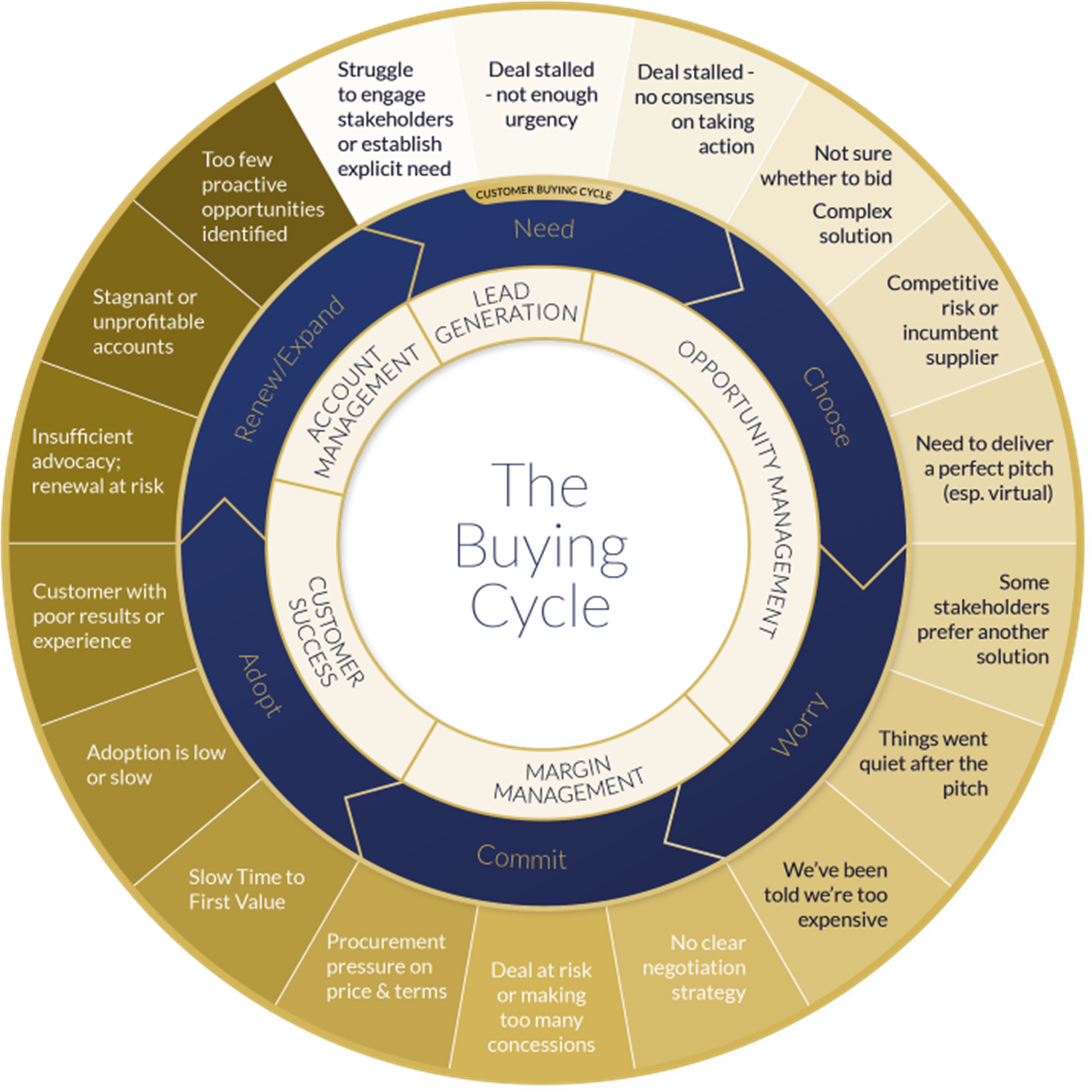

This sales training ecosystem is necessary, because it’s hard to say exactly what you’ll need to focus on in 2023. We identify at least 18 common issues around the customer’s buying cycle, and any or all of them may crop up when times are tough.

In the rest of this article, we’ve chosen one issue from each stage of the Buying Cycle that’s likely to be particularly important in 2023. However, we would emphasize that it’s important to be able to respond quickly whatever the priority.

Need

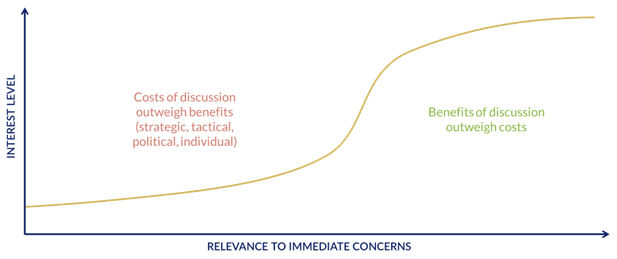

Issues with lead generation, deal velocity, and average deal size usually stem from an inability to uncover customer needs (i.e., objectives that are not being met). In tough times, customers become laser focused on their immediate priorities. There is a non-linear relationship between their interest in you and how relevant you are to these immediate concerns.

This means most salespeople will do much better researching a few likely prospects in depth, than they will trying to make a large number of shallow connections. In our Selling to the C-Suite program, for example, we often see genuine breakthroughs when salespeople prepare rigorously for outbound connections.

Use the annual report/10K (especially the management discussion), online searches, and connections within the industry to look for evidence of urgent, important objectives you can sell against. These will relate to key performance indicators, current challenges, or the company’s wider goals.

Choose

This is where customers evaluate competing solutions. If your win rate is falling, recognize that decision criteria change quickly under economic pressure. For example, high interest rates push up the cost of capital, so the cash profile of your solution is key.

Sales teams need to uncover the client’s current decision criteria and priorities – not rely on past experience. As covered in our Creating Client Value program, they need to develop strategies to deal with important criteria where they perform well (Winners), those where they don’t (Killers), and strengths the customer doesn’t currently perceive as important.

Worry

Having selected a preferred solution, customers often start to worry about what might go wrong in business and personal terms. As with so much, a recessionary environment only intensifies this stage of the cycle.

Teams need to be alert to the signs of risk (such as new decision makers being introduced) to improve their win rate vs. “do nothing” – often your biggest competitor. Provide collateral to correct any common misperceptions of risk, and train teams to reduce the likelihood of things going wrong – or the impact if they do.

Commit

At this stage the customer negotiates terms and commits to the purchase, with an impact on contract size, duration, and profitability.

Procurement becomes even more powerful when a business needs to reduce costs. Salespeople must recognize and respond to tactics such as best of best pricing, promising future gains, claiming lack of authority, nibbling, and reopening. This response can range from leveraging receptive stakeholders, to offering conditional give/get trades, to assessing the customer’s true alternative to doing a deal with you.

Adopt

In an environment where every expenditure is questioned, adoption rates need to be high in order to secure renewals down the line. Whether this is the job of an account manager or a dedicated customer success manager, it’s important to minimize the time to first value (TTFV) on new implementations, because the longer it takes for the customer to say, “Yes, that was worth doing,” the less likely a renewal becomes.

Equip your teams to influence best practices, create an effective joint team culture, mobilize resources, and treat users as customers with their own decision cycle.

Renew/Expand

During this phase the customer may choose to renew the solution or maybe even expand its use (or their work with the supplier) across the organization. It’s crucial for sales teams to understand and manage stakeholder alignment (promoters, detractors, passives, and time bombs), and to use emotional activators to turn promoters into evangelists.

It’s also critical to leverage promoters and evangelists by asking for internal support with renewals, and external support via referrals. Buyers are five times more likely to engage when introduced by someone they know (LinkedIn), and that goes up when times are difficult. Yet only 11% of salespeople regularly ask for referrals (Dale Carnegie).

These are just examples of the many issues you might face in 2023. Being able to recognize sales issues quickly – and “turn on a dime” to reinforce the relevant skills – will help your business survive and thrive whatever the economic weather.

Click here to download the interactive Account Troubleshooter to identify the typical issues throughout the buying cycle and the skill areas required to overcome them.

Richard Barkey is the founder and Chief Executive of Imparta, a global business that specializes in helping companies to achieve and sustain significant performance improvements across the whole field of sales, from retail and sales through service to sophisticated enterprise accounts, sales management, and sales leadership.

Get our Enewsletter

Get the latest sales leadership insight, strategies, and best practices delivered weekly to your inbox.

Sign up NOW →